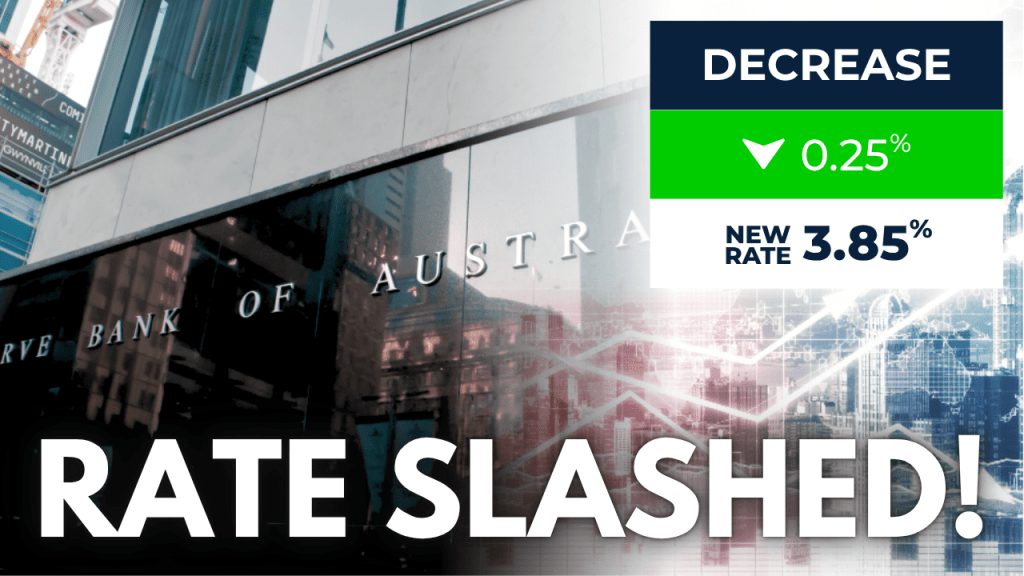

When the RBA rate cut hit the headlines, Aussie homeowners, renters, and investors all asked the same thing: Will this finally give us a break?

It’s a fair question—because whether you’re juggling a mortgage or struggling to get your foot in the door, interest rates make or break your strategy.

In this article, we’ll break down the real impact of the RBA’s decision, what it means for borrowing capacity, how it could shift the housing market, and most importantly—what smart investors should do next.

What Does the RBA Rate Cut Actually Mean?

When the Reserve Bank of Australia (RBA) slashes the official cash rate, it’s generally aiming to stimulate the economy. Lower rates mean lower borrowing costs—which can boost spending, investment, and borrowing.

For mortgage holders, this sounds like music to their ears. But it’s not always that simple. Banks don’t always pass the full cut on. And for renters or first-home buyers? Rate cuts can drive prices even higher by increasing demand.

The Link Between RBA Rate Cuts and Property Prices

The RBA rate cut doesn’t operate in isolation. It’s a signal. And the market listens closely.

- Lower interest rates = higher borrowing capacity

- Higher borrowing = greater demand for property

- Greater demand = upward pressure on prices

Add that to our already tight supply conditions, and we’re looking at a perfect storm for another surge in property values.

If you’re already in the market, this could be a win. If you’re trying to get in, it means waiting will cost you more later.

How Mortgage Holders Benefit from a Rate Cut

For Aussies with home loans, a rate cut could bring welcome relief. Monthly repayments go down, freeing up cash flow.

But it also opens a window to refinance into a better deal or restructure your investment lending. That could mean:

- Increased cash-on-cash returns

- Stronger rental yield margins

- More borrowing power for your next investment property

If you’re serious about property wealth, this is the moment to review your mortgage. Don’t wait until rates move again.

First-Time Buyers: Blessing or Curse?

You might assume a rate cut helps first-home buyers. And in some ways, it does.

But with demand heating up and competition rising, price growth could easily outpace the benefits. That means the window for first-time buyers is small—and shrinking.

Now more than ever, strategic buying and guidance from property professionals are essential to avoid being priced out again.

How Investors Can Leverage the RBA Rate Cut

Here’s where it gets exciting: for investors, rate cuts are like rocket fuel if you know how to use them.

Lower interest costs improve cash flow. And with the right tools—like suburb data, depreciation schedules, and expert due diligence—investors can:

- Buy in high-growth suburbs

- Secure properties with strong rent potential

- Ride the next wave of capital growth

Think of it this way: rate cuts create movement. Movement creates gaps. Gaps create opportunity.

The Bigger Picture: Why This Cut Matters Now

With high immigration, low construction rates, and shrinking housing stock, Australia’s property market is facing massive demand pressure.

The RBA rate cut comes at a critical time—when the market is still uncertain, but the fundamentals remain strong. That means anyone paying attention can get ahead before prices spike.

Want the Full Breakdown?

If you want to go beyond the headlines and understand the full picture, tune into the latest episode of the George Markoski Show:

“RBA Cuts Interest Rates: Will Aussie Mortgages Finally Get Relief?”

In this episode, I sit down with Christina to unpack:

- Why the RBA really cut rates

- How it affects mortgage strategy in 2025

- The biggest mistake to avoid if you’re looking to buy or invest

Listen here:

Final Thoughts: Rate Cuts Don’t Guarantee Wealth—Action Does

The RBA rate cut might be the break homeowners have been hoping for. But relief doesn’t equal results.

Those who act strategically—with data, timing, and support—stand to gain the most.

So ask yourself: is this the time you watch from the sidelines? Or the time you finally build momentum?

Stay sharp,

George Markoski

Positive Property